What does family governance entail?

In a family enterprise, governance is often misunderstood. A true family enterprise encompasses not only the financial capital—operating businesses, investments and philanthropic vehicles—but also the human capital that underpins it: the family itself, its values and the structures that guide collective decisions. At its core, family governance clarifies how choices are made, how and whose voices are heard and how differences are resolved in ways that protect both the family and the enterprise they steward. A new year presents a natural moment to step back and ask whether your current governance structures still support the family as it exists today, or whether they need to evolve to meet emerging challenges. And for families without formal governance in place, it’s an ideal time to consider what structures could strengthen relationships, reduce future conflict and support the long‑term health of the enterprise.

"Families that have succeeded for more than a century establish intentional governance through family councils, constitutions, and other structures decision-making bodies this became a cornerstone of maintaining both family and business continuity across generations"

- Dennis Jaffee, Ph.D., Author, Borrowed from Your Grandchildren: The Evolution of 100-Year Family Enterprises

When it's time to evolve or establish your family enterprise's governance

These are the five signs that signal your family has reached an inflection point where governance can no longer remain informal or needs to evolve.

Ownership or leadership changes: Governance often needs to evolve when a new generation joins the business or the board, when the shareholder group expands or when nonfamily executives take on greater responsibility.

Conflict begins to undermine the effectiveness: When family dynamics spill into business decisions, when conversations become more emotional than strategic or when the same issues resurface without resolution.

The enterprise becomes more complex: Growth brings new geographies, new business lines, diversified assets and more stakeholders.

Values and legacy feel at stake: As families look toward the next generation, many want to preserve shared values, prepare future leaders and create meaningful engagement for family members, including those not active in the business.

Legal, financial, or regulatory risks rise: Disagreements over ownership, dividends or capital allocation—combined with increasing regulatory and fiduciary obligations—signal the need for more intentional governance.

Why the most successful families plan ahead

Strong governance systems have a quiet but powerful effect: they protect both family relationships and enterprise value by preventing issues long before they surface. They create clear channels for communication, define expectations around decision making and establish processes that minimize misunderstandings.

Assessing where your family is today and needs to be tomorrow

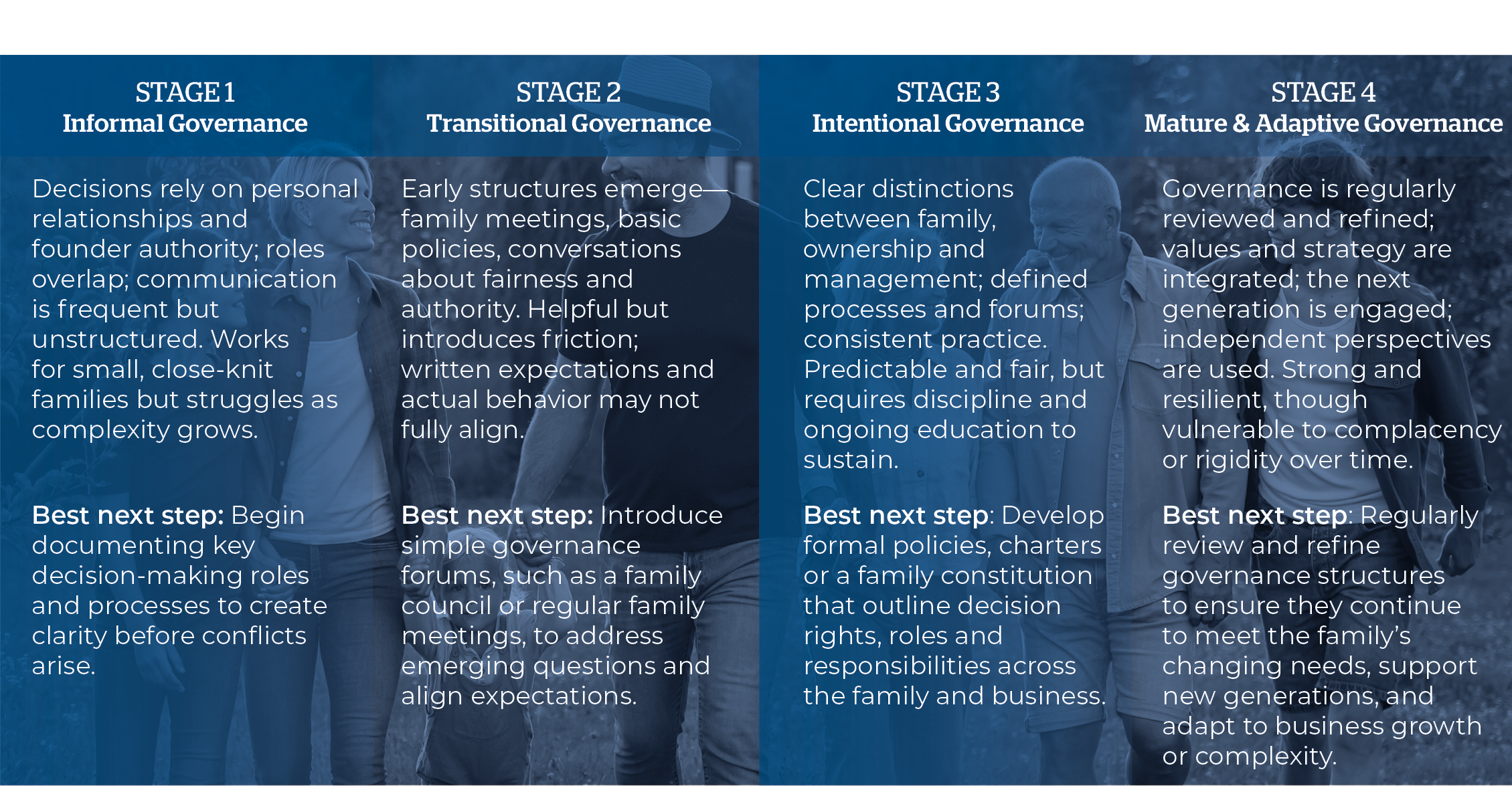

If you recognize that your family enterprise could benefit from creating or refreshing your governance structure, the first step is understanding where you are today. Family governance isn’t one size fits all; it evolves with your family, ownership structure and enterprise complexity. One helpful way to assess your starting point is through the Family Governance Readiness Spectrum, which highlights four stages of development and helps clarify the

most effective next step.

Family Governance Readiness Spectrum Source/Credit: Family Business Governance: Maximizing Family and Business Potential, Craig E. Aronoff & John L. Ward.

The choices that shape generations

Evolving your family’s governance is about far more than creating new structures, it’s about shaping a legacy that lasts. By recognizing the signals for change, understanding where you are on the governance journey and taking thoughtful next steps at the right moments, families can build systems that strengthen the enterprise and ensure both the business and the family legacy thrive for generations. If your family is considering ways to start, strengthen or refine its governance structures, The Family Office at Synovus team is available to support thoughtful dialogue and help you explore structures that promote clarity, alignment and effective decision making.

Disclosures

This report has been prepared from sources and data believed to be reliable but not guaranteed to or by Synovus Trust Company, N.A. Opinions expressed are subject to change without notice. Synovus Trust Company, N.A. has prepared and presented this report for the sole usage of its clients as information and is neither an offer to sell nor a solicitation of an offer to buy any security.

Family office services are provided through The Family Office at Synovus, a division of Synovus Trust Company, N.A. Investment products and services are offered through Synovus Securities, Inc("SSI"), Synovus Trust Company, N.A. ("STC"), and Creative Financial Group, a division of SSI. Trust services are provided by Synovus Trust Company, N.A. The registered broker-dealer offering brokerage products is Synovus Securities, Inc., member FINRA/SIPC and an SEC Registered Investment Adviser. Investment products and services are not FDIC insured, are not deposits of or other obligations of Pinnacle Bank, are not guaranteed by Pinnacle Bank and involve investment risk, including possible loss of principal amount invested. Synovus Securities, Inc. is a subsidiary of Pinnacle Financial Partners, Inc., and an affiliate of Pinnacle Bank, a Tennessee bank, d/b/a as Synovus Bank and Synovus Trust. Synovus Trust Company, N.A. is a subsidiary of Pinnacle Bank, a Tennessee bank d/b/a Synovus Bank.

Tags:

Rising Gen EducationFebruary 12, 2026